Payroll Software

Painless Payroll Processing

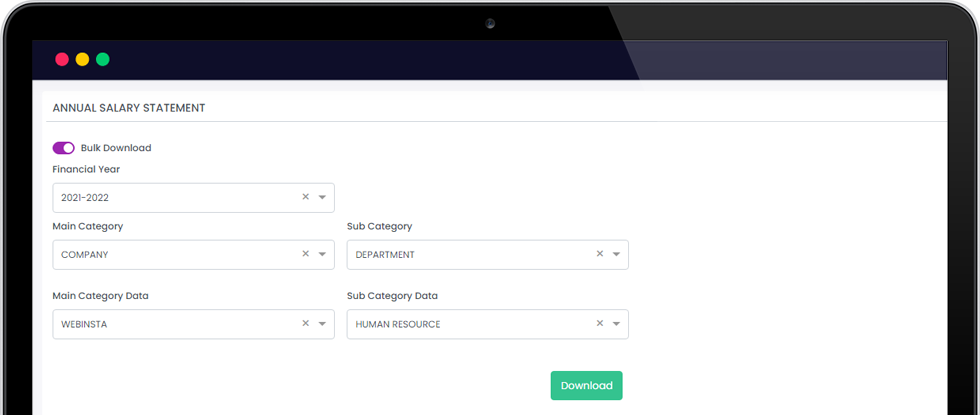

Ensure painless payroll and compliance with comprehensive & user-friendly payroll solutions. Insightful reports beyond numbers & budget, with a centralized and secured database. Automating payroll systems is more secure, quick, error-free, and reliable. It keeps your system updated with the latest statutory norms. Streamline your attendance, payroll, TDS, EPF, ESI, and other statutory deductions in just one click.